November 2013 • 19

EIA Publishes

Favorable Price Forecast

HEATING OIL MARKETERS GOT SOME GOOD

news last month when the U.S. Energy

Information Administration (EIA) predicted

that heating oil costs would drop this winter

while natural gas heating costs would rise.

EIA forecasted household heating costs

in its annual

Winter Fuels Outlook

, saying

that natural gas heat will cost 13 percent

more this winter if the weather plays out

according to the government’s winter

forecast. If the weather is 10 percent colder

than forecast, natural gas heat costs will rise

by 25 percent.

The

Winter Fuels Outlook

calls for

heating oil costs to decrease by 2 percent

if the government’s forecast is accurate.

A winter that is 10 percent warmer than

the base forecast would lead to a 13 percent

reduction in heating costs. A winter that is

10 percent colder than the forecast would

cause a 9 percent increase in heating costs.

The EIA predicts that propane heating

will cost 9 percent more this winter than

last winter. (The agency did not offer alter-

native pricing scenarios based on weather

variations for propane heating.)

NATURAL GAS SUPPLY CRUNCH

Natural gas costs in the Northeast region

are expected to rise more than national

average, with the average gas-heated house-

hold facing an 18 percent cost increase,

according to EIA. The region’s reliance on

natural gas for electricity generation has

increased from 30 percent to 52 percent

over the last 11 years.

“Increased gas use for power generation

has contributed to pipeline transportation

constraints in the New England regional

natural gas market,” EIA reports. “These

pipeline constraints are more pronounced

in winter months and contributed to

extreme spot price spikes in natural gas and

electricity prices in New England during

January and February 2013.

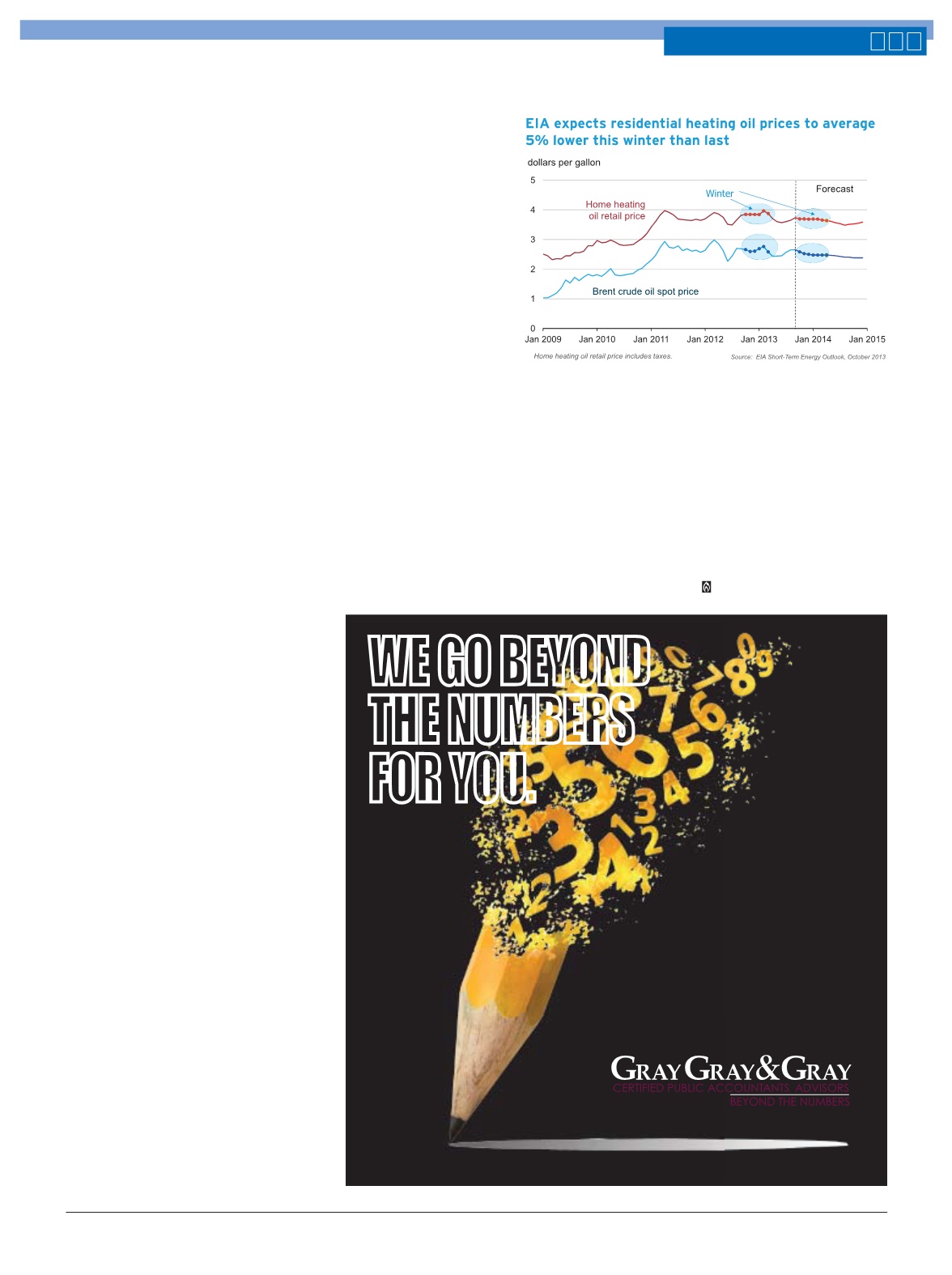

EIA is projecting the retail price of

heating oil to average $3.68 per gallon this

heating season (October 2013 to March

2014). This price would be 19 cents per

gallon lower than the average price during

the winter of 2012-13 and reflects EIA’s

lower price forecast for Brent crude oil.

This winter, EIA expects Brent crude oil to

average $105 per barrel ($2.50 per gallon)-

about $6 per barrel (14 cents per gallon)

lower than last winter.

As the energy industry’s

OHDGLQJ DFFRXQWLQJ ÀUP

*UD\ *UD\ *UD\ JRHV

EH\RQG WKH QXPEHUV WR GHOLYHU

LQVLJKWV DQG LQIRUPDWLRQ WR

KHOS PDNH \RXU EXVLQHVV PRUH

SURÀWDEOH &DOO -RH &LFFDUHOOR DW

WR ÀQG RXW KRZ

|

ZZZ JJJFSDV FRP _

WE GO BEYOND

THE NUMBERS

FOR YOU.

While U.S. distillate

production is high and

prices and expenditures

are expected to be

lower than last year, the

global supply-demand

balance for distillate

fuels has created a price

structure that has not

encouraged inventory

builds, according to EIA.

Strong demand abroad for distillate fuel,

particularly in Europe and Latin America,

resulted in record levels of U.S. exports

over the summer. That demand has pushed

up prompt prices for distillate futures

contracts, which have been traded at a

persistent premium to those for delivery

further in the future.

VOLATILITY RISK

For the week ending on September 27,

distillate inventories in the U.S. Northeast

were 29.4 million barrels, about 17.3 mil-

lion barrels (37 percent) below their five-

year average level, but only 0.9 million

barrels below the 2012 end-of-September

levels. Distillate inventories have his-

torically been used to meet normal winter

heating demand but are also an important

source of supply when demand surges as

a result of unexpected or extreme cold

spells. The low distillate inventories could

contribute to heating oil price volatility

this winter.

Fuel