The Stats Page

Industry News

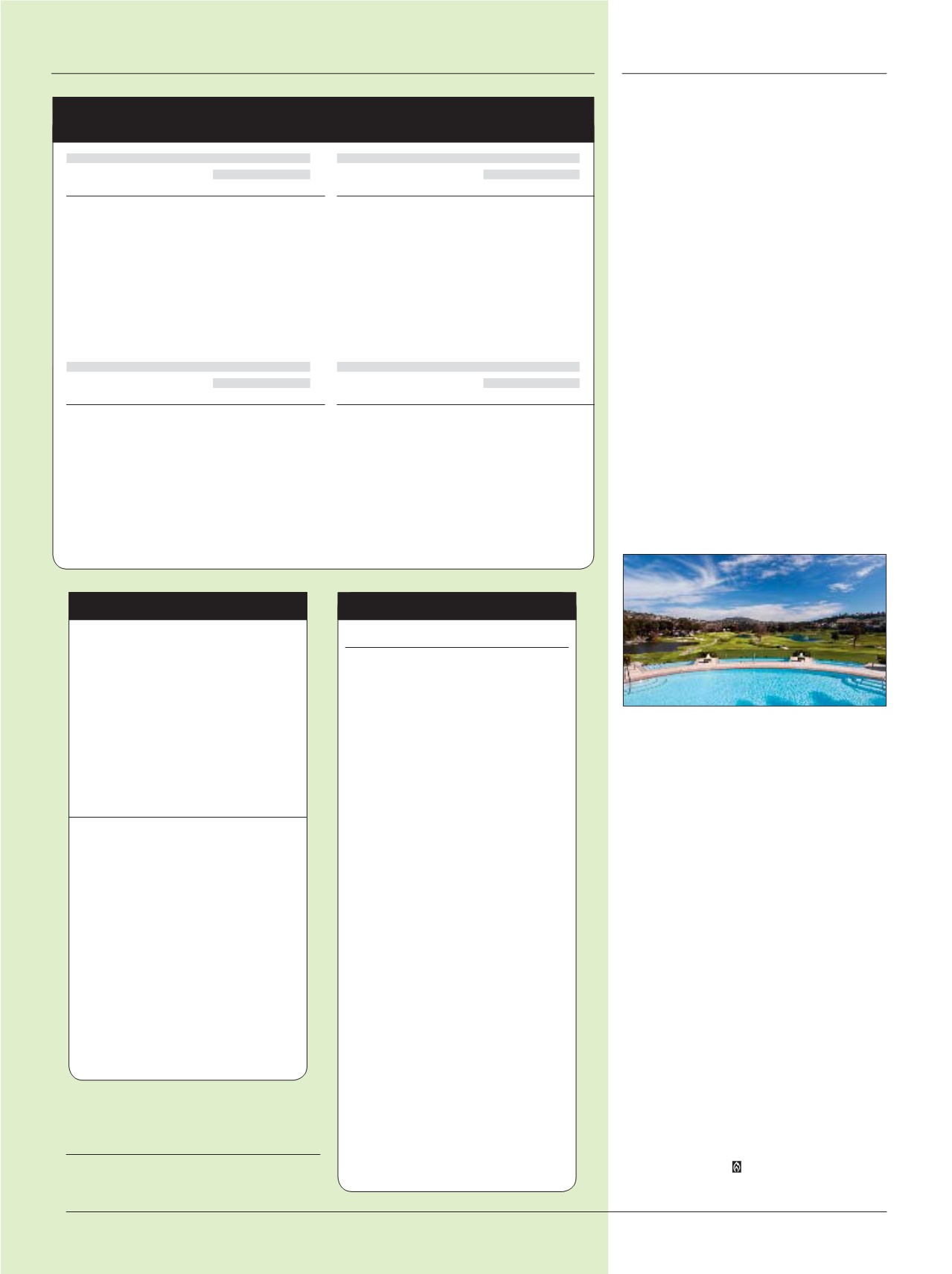

Distillate Stocks by PADD (Million Barrels)

PRODUCTS IN STOCK: MOST RECENT WEEKS

Ultra-Low Sulfur / 15 ppm and under

Week Ending

District

10/04/13 09/27/13 Year Ago

East Coast (PADD 1):

27.7

29.6

19.4

NEW ENGLAND:

1.8

1.7

1.6

MID-ATLANTIC:

15.5

17.2

8.2

SOUTHTO FLA:

10.4

10.7

9.6

Midwest (PADD 2):

28.2

29.2

25.4

Gulf Coast (PADD 3):

32.8

33.4

30.5

Rocky Mtn. (PADD 4):

3.5

3.3

3.1

West Coast (PADD 5):

10.8

11.0

11.0

U.S. Total

103.0

106.5

89.3

Low Sulfur / 15 ppm+ to 500 ppm

Week Ending

District

10/04/13 09/27/13 Year Ago

East Coast (PADD 1):

1.5

1.2

0.8

NEW ENGLAND:

0.0

0.0

0.0

MID-ATLANTIC:

1.1

0.8

0.5

SOUTHTO FLA:

0.3

0.3

0.3

Midwest (PADD 2):

0.6

0.6

1.1

Gulf Coast (PADD 3):

2.0

2.3

3.0

Rocky Mtn. (PADD 4):

0.2

0.2

0.1

West Coast (PADD 5):

0.3

0.4

0.8

U.S. Total:

4.5

4.7

5.8

Greater than 500 ppm (0.05%) Sulfur

Week Ending

District

10/04/13 09/27/13 Year Ago

East Coast (PADD 1):

10.9

10.7

19.2

NEW ENGLAND:

4.1

3.9

6.2

MID-ATLANTIC:

6.0

5.8

11.8

SOUTHTO FLA:

0.8

1.0

1.2

Midwest (PADD 2):

0.9

0.9

1.2

Gulf Coast (PADD 3):

5.4

4.9

4.2

Rocky Mtn. (PADD 4):

0.1

0.2

0.1

West Coast (PADD 5):

1.2

1.3

1.1

U.S. Total

18.5

18.0

25.8

TOTAL DISTILLATE STOCKS

Week Ending

District

10/04/13 09/27/13 Year Ago

East Coast (PADD 1):

40.0

41.5

39.4

NEW ENGLAND:

6.0

5.6

7.8

MID-ATLANTIC:

22.6

23.9

20.4

SOUTHTO FLA:

11.4

12.1

11.1

Midwest (PADD 2):

29.7

30.7

27.7

Gulf Coast (PADD 3):

40.2

40.7

37.6

Rocky Mtn. (PADD 4):

3.8

3.6

3.3

West Coast (PADD 5):

12.4

12.7

12.9

U.S. Total

120.9

126.0

120.9

Sources:

Energy Information Administration, Weekly Petroleum Status Report.

For information about distillate stocks, contact Diana House:

202-586-9667 or by e-mail at

46 • OIL

&

ENERGY

the biofuels market: federal biodiesel

blenders’ tax incentives; the Renewable

Fuel Standards (RFS2); and state and local

incentives and requirements.

Scharingson explained that REG offers

three REG-9000 products produced from

different feed stocks, which have different

cloud points to allow for better cold weather

planning. He went into additional details

regarding the use of additives and REG’s

insulated and heated tankers and rail cars.

The company marketed 189 million

gallons of biodiesel in 2012, and currently

has 250 million gallon production capacity.

REG recently celebrated the grand opening

of its sixth northeast terminal at the IMTT

Terminal in Bayonne, NJ, joining facilities in

Ontario, NY, Whippany, NJ, Port Chester,

NY, New Hyde Park, NY and Yaphank, NY.

Scharingson stressed that the company is

always looking to add terminal locations,

and invited the audience members to speak

to him directly about any opportunities of

which they might be aware.

PMAA PAC FUNDRAISER AT

OMNI LA COSTA RESORT

Petroleum Marketers Association of

America (PMAA) Small Business Committee

(SBC) PAC Co-Chairs Gerry Ramm and

Michael Fields invite marketers to attend

an event this month in beautiful Southern

California benefiting PMAA’s SBC PAC.

The event will be held at the Omni La

Costa Resort and Spa ($209 per room)

November 20-21, 2014. The hotel rate is

good three days before and after the event if

you want to come early or stay longer. Cost

is $500 per golfing registrant and $200 for

non-golfing guest.

The event will start Wednesday evening,

Nov. 20, with a cocktail reception from 6 to

7 p.m. and dinner immediately to follow on

the resort. On Thursday, former two-time

PGA Championship winner Dave Stockton

will give golf lessons to attendees from 8 to

11 a.m. followed by 18 holes of golf on La

Costa’s Champions Golf Course.

For more information or to register,

call PMAA at (703) 351-8000 or e-mail

Oil & Energy Securities Recap

Company

Symbol

10/14/13

09/13/13 Change

Weather Summary

Selected U.S. Cities

(Population Weighted Heating Degree Days)

The weather for the nation, as

measured by population-weighted

heating degree-days from July 1, 2013,

through October 12, 2013, has been 25

percent warmer than last year and 25

percent warmer than normal.

Current

Normal

% Change

7/1/13

7/1

Current

thru

thru

vs.

Location

10/12/13

10/12

Normal

Boston

139

194

-28%

Chicago

117

241

-51%

Hartford

198

257

-23%

NewYork

46

106

-57%

Philadelphia

59

112

-47%

Pittsburgh

141

239

-41%

Portland

323

420

-23%

Providence

148

223

-34%

Raleigh

32

69

-53%

Richmond

34

85

-60%

Washington

27

47

-43%

Ashland Inc.

ASH

88.39

91.41

-3.4%

BP-Amoco

BP

42.60

41.94

1.5%

ChevronTexaco

CVX

118.58

124.14

-4.5%

Conoco Philips

COP

71.96

69.19

4.0%

Energy Transfer Partners

ETP

51.87

50.87

2.0%

ExxonMobil

XOM

87.60

88.40

-0.9%

Global Partners

GLP

32.11

32.60

-1.5%

Hess Corp.

HES

81.31

77.72

4.6%

LUKOIL

LUKOY

65.99

61.70

6.9%

Marathon Oil

MRO

34.83

35.57

-2.1%

National Grid Plc

NGG

60.29

58.47

3.1%

Occidental

OXY

95.71

89.49

7.0%

Royal Dutch Shell Plc

RDSA

64.94

65.49

-0.8%

Star Gas

SGU

5.15

4.75

8.4%

Tesoro Petroleum

TSO

45.57

46.11

-1.2%

Total

TOT

59.23

56.78

4.3%

Valero Energy

VLO

36.57

35.05

4.3%