36 • OIL

&

ENERGY

Software

Hedge Insite Helps Fuel Marketers See Ahead

HEDGE INSITE IS A RISK MANAGEMENT TOOL

that helps fuel marketers peer into the

future and evaluate their hedging positions

and improve profitability.

Oil & Energy

recently caught up with Hedge Insite’s man-

aging partner Richard Larkin to learn more

about the software.

Please recount the origins of Hedge Insite.

What were you setting out to do when you

developed the software?

The idea for Hedge Insite originated

from worksheets we had developed inter-

nally at Hedge Solutions that had evolved

over the 15-year history of the company

at that time. The origins go back as far

as 1993 when I was using Lotus to track

my clients’ positions. After trying out dif-

ferent software environments like Excel

and Access, we were approached with the

idea of developing a [software as a service

(Saas)] application that would allow the

user to see the forward profit and loss

(P&L), stress different strategies, and

track their positions. For my consulting

company, Hedge Solutions, it provided a

platform that we could manage our clients’

hedging and procurement strategies on.

Also, we could protect our trade secret

methodologies for hedging while simul-

taneously providing transparency on the

results to the end user.

Please discuss Insite’s price forecasting.

What does it do?

To be clear, Hedge Insite does not

forecast oil or propane prices. Put simply,

Hedge Insite allows the user to run simula-

tions of future revenue and cost streams

and thereby estimate profitability. On the

revenue side, the user can enter any kind

of forward sales offers; cap, fixed, variable,

index pricing, and minimum/maximum

pricing. On the cost side, the hedging

strategy is input: wet barrels, options,

futures contracts, swaps, etc. It will also

allow you to consider inventory as a hedge

by moving it forward against the calendar.

All the variables that can impact your cost of

sales and ultimately your profit margin are

factored into the software: basis, weather,

etc. Once you input your information, the

software will give you over 240 iterations

based on the movement of the underlying

commodity price and display the results

on a simple line graph. A flat line indicates

that you will achieve your margin goal no

matter what the price does. A line that tilts

to the left or right indicates that you may

fall short or possibly exceed your margin

forecast based on the same price movement.

Hedge Insite complements the back office

host system by providing a

forward

view of

where the company is headed.

What is “stressing” in Hedge

Insite, and why is it important?

The “stress test” as it is named in the

software, allows the user to manipulate

the data in the program without impacting

the original inputs and results from those

inputs. The stresser enables the user to

“test” a variety of hedging strategies to

evaluate their impact to the bottom line

before making a decision. It removes the

guesswork. The stress test function also

enables the user to stay on forecast month to

month, but if and when events take the user

“off course” the tools in the software help

him define the best tactics for “returning to

the desired P&L course.”

I like to call it a practice area. It virtually

duplicates the original Hedge Insite envi-

ronment in a separate “view” or

window. You can then change

the variables that might impact

your forecast for profit so that

you can test a certain strategy

or simply see what impact the

changes made will have on your

P&L. Some examples are:

• You can add wet barrels and

graph the result.

• You can increase or decrease

the volume of sales in a way

that will simulate a change

in weather; and then graph

the result.

• You can change your basis

assumption or rack to posted

profit forecast in order to see

what that impact would have

on your P&L.

There really is no limit to

what you can “stress.” But when

you are done, you simply close

out of the stresser and go back to

the protected core data.

How does the customer’s

information get entered

into Insite?

Information

is

entered

through intuitive data entry

screens. The fields are labeled,

making it easy to identify what information

should go in there. For example: when

entering a call option: the data entry screen

will have the following pre-labeled fields:

date, delivery month, market month, gal-

lons, strike price, and premium. Other fields

are optional such as description, supplier/

broker, code, etc.

How does Hedge Insite interact

with back-end office software?

Hedge Insite has the capability to con-

nect to most popular software vendors

using a CSV file format. Import/export of

data is handled through a standard CSV file

format.

How do customers access and use Insite?

Hedge Insite uses a subscription-based

software model. Because it is a Saas applica-

tion, the software is easily downloaded onto

the desktop. The data is stored on profes-

sionally hosted, remote and secure servers.

From the desktop the program is accessed

by username and password.

Hedge Insite can stress-test a hedging position.

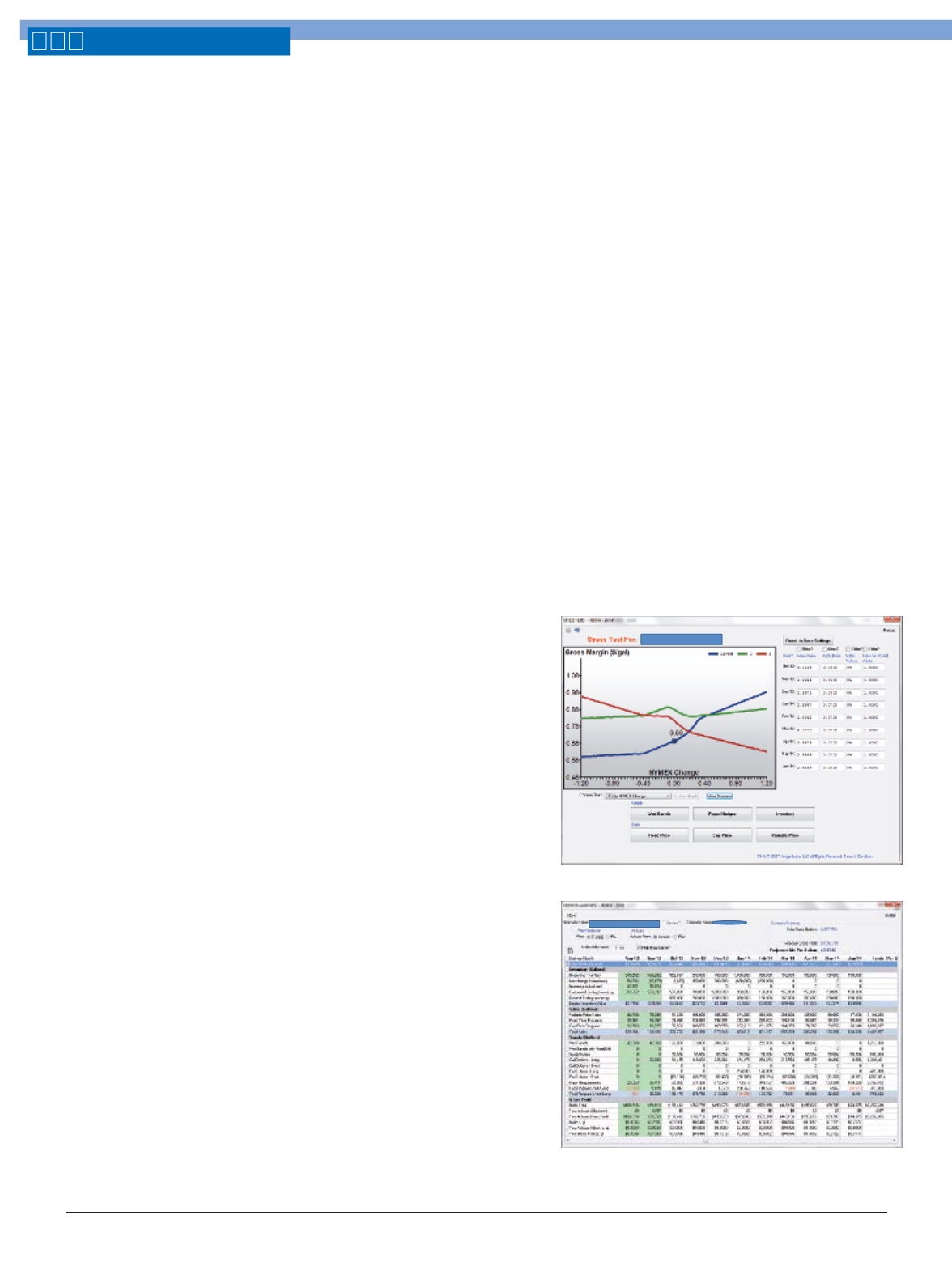

Marketers can use Hedge Insite to

evaluate their purchases and options.