Î{ÊU "

&

ENERGY

?\[^`e^ 8^X`ejk =`o\[ Gi`Z\ :fekiXZk ;\]Xlckj

By Rick Trout and Jarrod Robinson, Account Executives, Hedge Solutions

Market Stance

L% J% D8IB<KJ# @E G8IK@:LC8I K?< JKF:B

markets and petroleum markets, have, with

considerable help from the Federal Reserve,

made a stunning recovery from the 2008

price plunge. Does this mean that we are

in a position where we could experience

another hefty price drop? Perhaps, so it’s

relevant that we ponder the lessons learned

five years ago and consider a couple of

applicable hedging strategies.

:FEJLD<I ;<=8LCKJ

In the 2008/2009 heating season,

arguably the most disastrous outcome

experienced by heating oil retailers was

widespread consumer defaults on fixed

price purchase commitments. The problem

here is that customers committed to buy

heating oil at a fixed price, and the dealer

in turn committed to a lower fixed price

hedge, theoretically locking in an accept-

able margin. When prices went into the

tank and consumers refused to take delivery

of high-priced heating oil, the retailer was

compelled by suppliers to buy high-price

contract gallons with no opportunity to

resell these gallons at a corresponding high

retail price, resulting in inadequate, some-

times even negative, margins.

In response, dealers consulted with their

attorneys and tightened up their price pro-

tection contracts, so that they could more

successfully pursue legal action against

non-compliant fixed price customers. Many

also resolved that going forward, they will

offer only capped price contracts. The logic

behind this decision is undeniable. A lack of

price protection is great if prices are falling,

but the unprotected consumer is vulnerable

to price increases. A fixed price contract

protects against rising prices, but the fixed

price consumer can’t participate in lower

prices. Only the customer who opts for a

capped price is shielded from higher prices,

while being able to enjoy bargain prices.

The capped consumer elects superior (and

the only truly effective) coverage and not

surprisingly, there is a higher price, i.e. cap

premium add-on, associated with the best

insurance available.

However, there are markets where hom-

eowners rail against paying cap premiums

and prefer to purchase “free” fixed price

half protection rather than more expensive

capped price full protection. Heating oil

retailers in these markets must offer fixed

price programs or forego selling to a pos-

sibly substantial segment of the customer

base. In this circumstance, the dealer would

be wise to obtain payment for all or most of

the fixed price gallons up front or at least

prior to the start of the heating season.

If this is not possible for a sizable portion of

the fixed price volume and there is a real-

istic possibility of falling prices, the seller

has default risk.

?<;>@E> 8>8@EJK ;<=8LCKJ1

FLK F= K?< DFE<P :8CC FGK@FEJ

An example illustrates this risk and

how to hedge it. Let’s say that 200,000

gallons of pay-on-delivery, fixed price

gallons are sold to consumers. Based on

2008/2009, the retailer estimates that if

the price of heating oil falls $1.00, he is

likely to experience defaults on 30% of this

volume, which is 60,000 gallons. The goal

is to hedge the 140,000 fixed price gallons

that are not vulnerable to default and

to hedge the 60,000 gallons of potential

“involuntary, no premium caps” that carry

downside risk for the seller. Hedging the

140,000 gallons is easy; purchasing wet

barrel contracts on a heat curve will get

the job done. Hedging the potential default

gallons requires more creativity, and mod-

eling tools at Hedge Solutions verify that a

viable hedge is 20 cents out of the money

call options. The following graphs capture

this modeling:

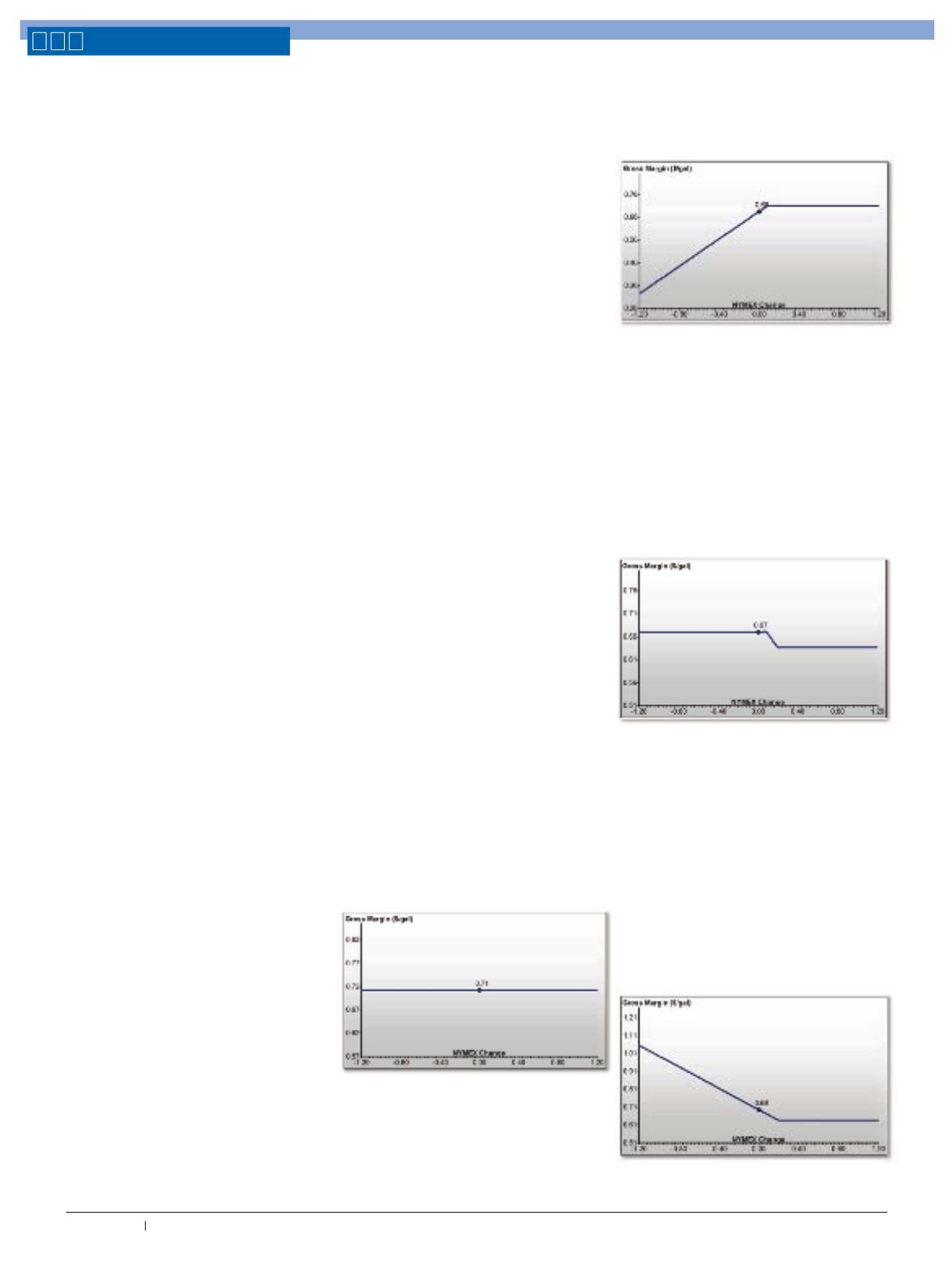

If a heating oil retailer sells 200,000

fixed price gallons to consumers, hedges

these sales with 200,000 wet barrel contract

gallons purchased from a supplier and expe-

riences no consumer defaults, modeling

shows the following program profitability

profile. Note that margin is extremely

stable, whether prices rise or fall.

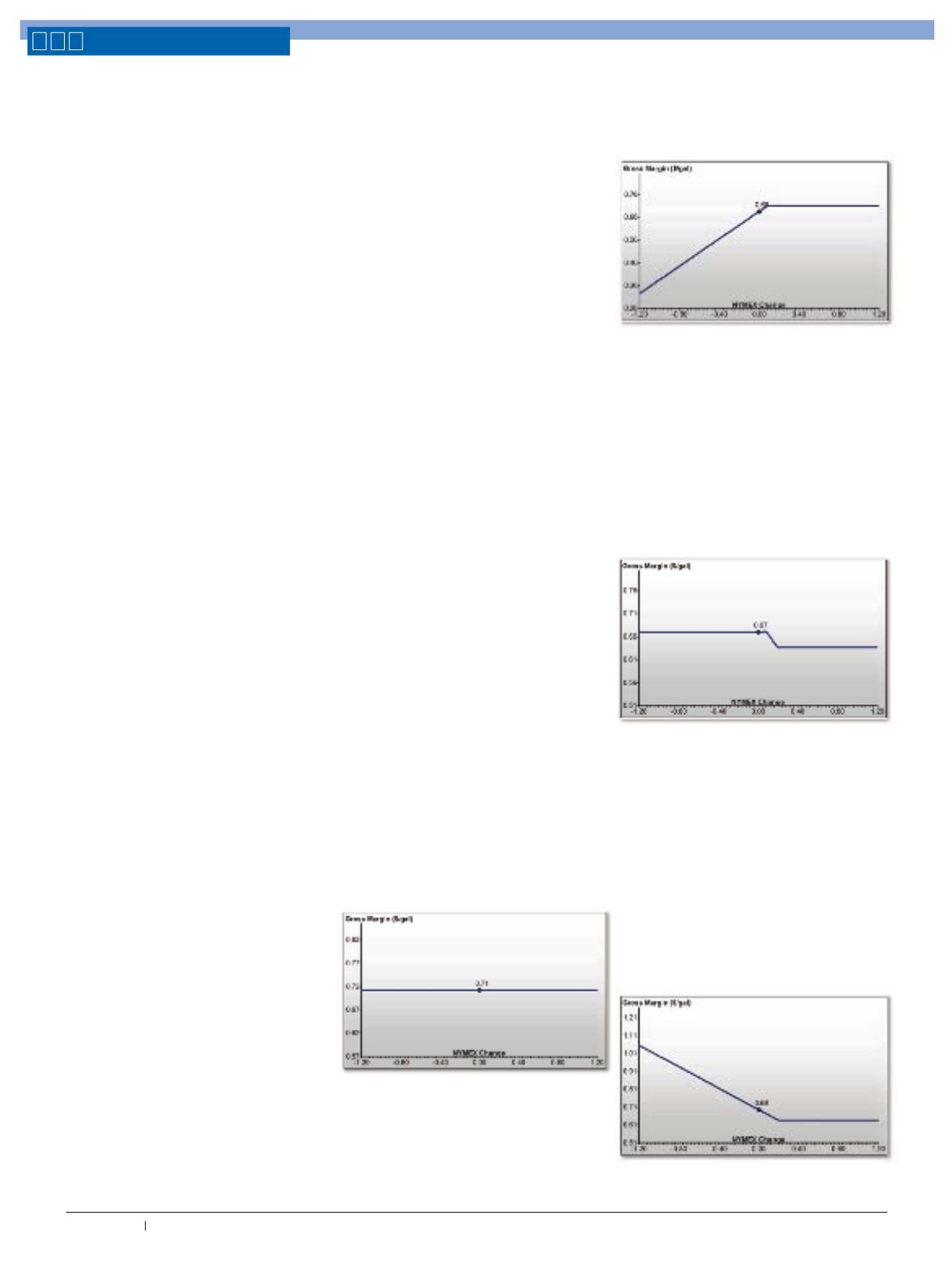

If, however, prices decline significantly

and 30 percent of consumers default and

refuse to take delivery of their fixed price

gallons, the retailer’s profitability profile is

altered as follows:

Since prices have presumably fallen at

least $1.00, the retailer’s margin has been cut

in half or worse. However, perhaps because

the petroleum products market showed

signs of weakness, the retailer anticipated

a price drop-off and the potential for

defaults, so he hedged 70 percent of his

fixed price sales with supplier wet barrel

contracts and the remaining 30 percent

with 20 cents out of the money call options.

What does this strategy do to his profit-

ability profile? The answer is:

This profile is considered quite accept-

able. Margin in a falling market is 67 cents

and stable, and margin in a rising market

is 63 cents and stable. The cost of the call

options in this illustration is about 8 cents per

gallon or $4,800 (less closer to the heating

season and more further from the winter),

is included in the modeling and cannot be

passed on to customers as a cap fee.

If you wonder what the profitability

profile looks like if you cover potential

defaults with 20 out call options and the

defaults don’t occur, please note the fol-

lowing graph:

:fek`el\[ ¿