?<;>@E> 8>8@EJK ;<=8LC

KJ1 G8IK@8CCP

LE?<;><; =@O<; GI@:

< J8C<J

If the retailer d

oesn’t want to bear

the cost of 20

out call options, he c

an

still hedge

(sort of) against fixed

price

defaults. C

onsider for a moment

that the

most f

undamental upside pro

tection is

a fixe

d price hedge and t

he most funda-

me

ntal downside protect

ion is no hedge.

It’s going to be cru

de and imprecise, but

a combination of

these two approaches

is another way

to hedge against defaults.

The follow

ing illustrates this hedging

concept:

The heating oil retailer sells 200,000

fix

ed price gallons to consumers,

hedges these sales with 168,000 wet

barrel contract gallons purchased from

a supplier, leaves the remaining 32,00

0

gallons of fixed price sales unhe

dged

and experiences 30 percent d

efaul

ts.

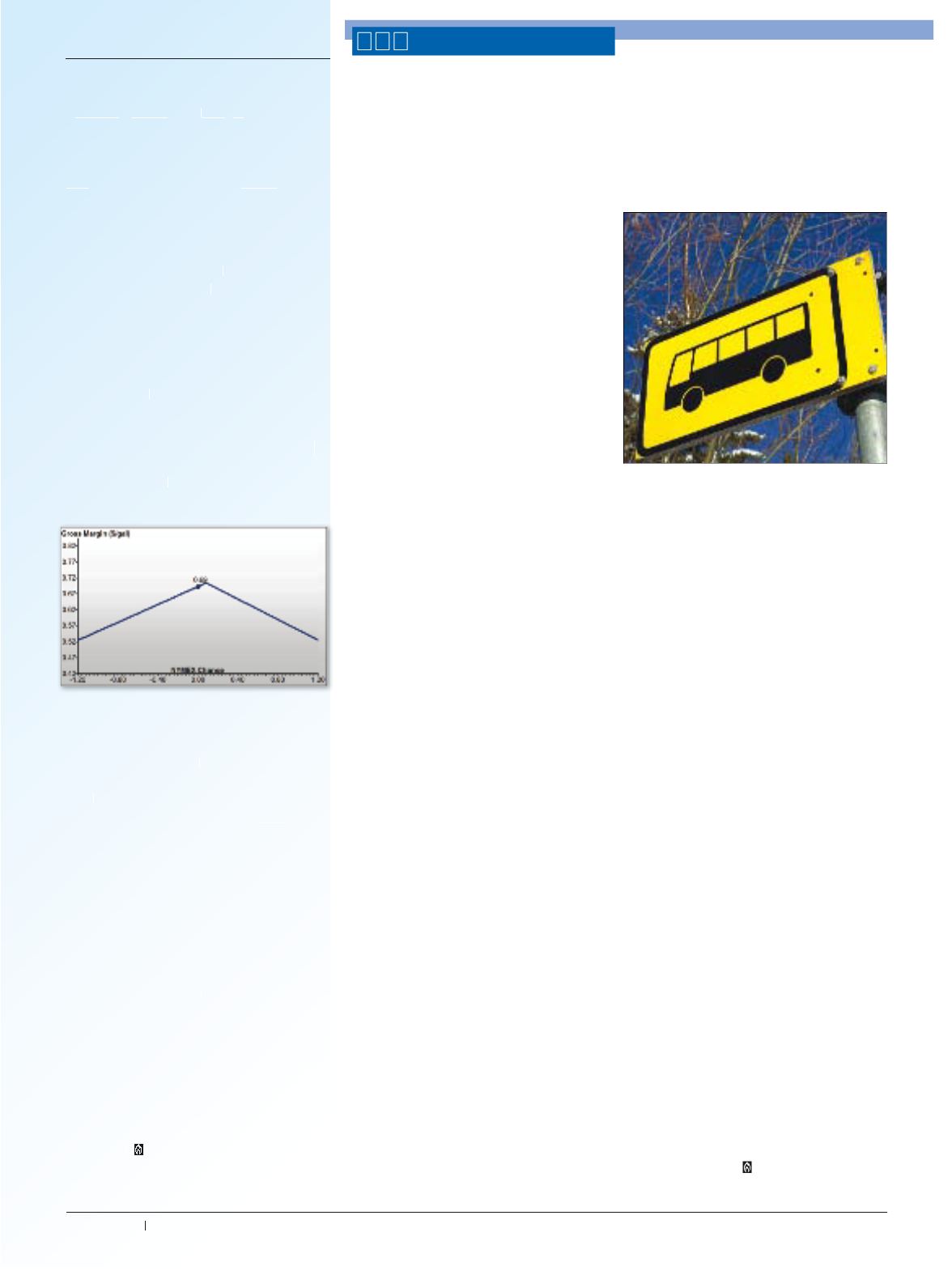

Modeling shows the followin

g pro

gram

profitability profile:

At the curre

nt price, margin is 69

cents. If price

goes up $1.20 or down

$1.20, margi

n is 53 cents. That’s a

16

cent varia

tion, which is not very

good,

but on

the downside, it’s a l

ot better

than

the graph above (200K

fixed price

he

dges, no default hedge

s, 60K [30 per-

cent] defaults) where i

f price falls $1.20,

the margin is 32 cen

ts.

JLDD8IP

In sum

mary, here are the alternatives

for add

ressing the possibility of fixed

pric

e contract defaults, in order of p

refer-

e

nce: (1) Don’t sell fixed pri

ce gallons

(caps price only); (2) Colle

ct as much

fixed price money as pos

sible prior to

the start of the heating

season; (3) Hedge

potential fixed pric

e defaults with 20

cents out of the m

oney call options; and

(4) Leave som

e of the fixed price s

ales

unhedged

. How much unhedged?

Tha

t

can be

difficult to determine

withou

t

the b

enefit of a modeling t

ool, suc

h as

th

e proprietary softwar

e used b

y Hedge

Solutions.

>ÀiÌ -Ì>Vi

ÎÈÊU "

E

, 9

iiÌÊ >>}iiÌ

:fek`el\[ ]ifd gX^\ *+ ¿

EKJ9 ;\dXe[j 8l[`k f] =D:J8

Dispute could lead to tougher enforcement activities

By Matthew Wrobel, Foley Services

J:?8;<E=I<L;<% K?8KËJ EFK 8 KPGF Ç

it’s a (long) German word that means taking

pleasure at the misfortune of others. There

are going to be plenty of motor carriers

feeling that way this month, as the National

Transportation Safety Board has laid a

broadside at the Federal Motor Carrier

Safety Administration.

Citing a number of accidents that it has

investigated, the NTSB has raised ques-

tions about FMCSA’s ability to regulate the

industry and improve safety. The NTSB has

demanded that FMCSA undergo a full audit

by government officials.

While it would probably be difficult

to find any sympathy at carriers who have

undergone an FMCSA audit or Compliance

Review, motor carriers should be wary

about what that could mean. The results of

the audit are unlikely to improve the situa-

tion for carriers. Much more likely, it means

that enforcement and oversight is going to

get much worse.

EKJ9 :FDGC8@EKJ

Essentially, NTSB has said that FMCSA

is not doing enough to prevent accidents

involving motor carriers (FMCSA’s mission

statement). They have also raised concerns

that FMCSA’s new systems (CSA) are not

aggressive enough at going after carriers

with past violations.

“While FMCSA deserves recognition

for putting bad operators out of business,

they need to crack down before crashes

occur, not just after high visibility events,”

said NTSB Chairman Deborah A.P.

Hersman. “Our investigators found, that in

many cases, the poor performing company

was on FMCSA’s radar for violations but

was allowed to continue operating and

was not scrutinized closely until they had

deadly crashes.”

NTSB criticized the “quality and thor-

oughness” of FMCSA’s compliance reviews

and took a hard line against FMCSA per-

forming focused compliance reviews that

only look at one area of the regulations.

8::@;<EKJ

NTSB has come to this point after

investigating a number of accidents that it

believes FMCSA had the power to prevent.

In the four cases, FMCSA had either been

investigating the carrier for other reasons

and failed to note issues that contributed

to crash or they had deemed the carrier to

be safe. NTSB was disturbed by the fact that

these carriers, rated ‘satisfactory,’ could be

found non-compliant so quickly after the

accident.

The four accidents cited occurred in the

last 12 months, indicating that this is an

ongoing problem that has not been solved

by the shift to CSA-based compliance. The

four accidents include:

U *i`iÌ "Ài°] iV° Îä] Óä£Ó

U -> iÀ>À`] >v°] iL° Î] Óä£Î

U â>LiÌ

ÌÜ] Þ°] >ÀV

Ó] Óä£Î

U ÕÀvÀiiÃLÀ] /i°] Õi £Î] Óä£Î

N?8K ;F<J K?@J D<8E6

Unfortunately, this probably means that

we can expect an increase in enforcement

in the next few years. It continues a trend

from recent months that is forcing FMCSA

to behave much more aggressively towards

carriers. Other recent changes include a

Congressional directive that FMCSA can

no longer take a carrier’s ability to pay as a

factor when deciding to levy fines for non-

compliance.

If NTSB gets its way (and it usually does,

as the passenger car and airline industries

can tell you), FMCSA will have to increase

the depth and number of compliance

reviews. It will mean more inspections and

much less leeway if errors are found.

While many carriers would laugh at this

statement, FMCSA is actually comparatively

friendly towards the industry. Between the

recent developments in Congress and the

results of this audit, we could see a big shift

in that relationship toward one that is much

more antagonistic.