The Internal Revenue Service (IRS) has published initial guidance on federal tax credits for home energy efficiency improvements, including a $600 credit for the installation of qualified heating systems.

The recently enacted "Inflation Reduction Act" (IRA) significantly expands the existing "non-business energy property tax credit" under Section 25C of the Internal Revenue Code, commonly referred to as the "25C credit". Beginning January 1, 2023, homeowners may be eligible for an annual credit of 30% (subject to certain limits) for the installation of energy efficient HVAC appliances and certain envelope components, such as insulation and efficient doors and windows. This tax credit has no lifetime limit and can be taken each year through expiration of the credit on December 31, 2032.

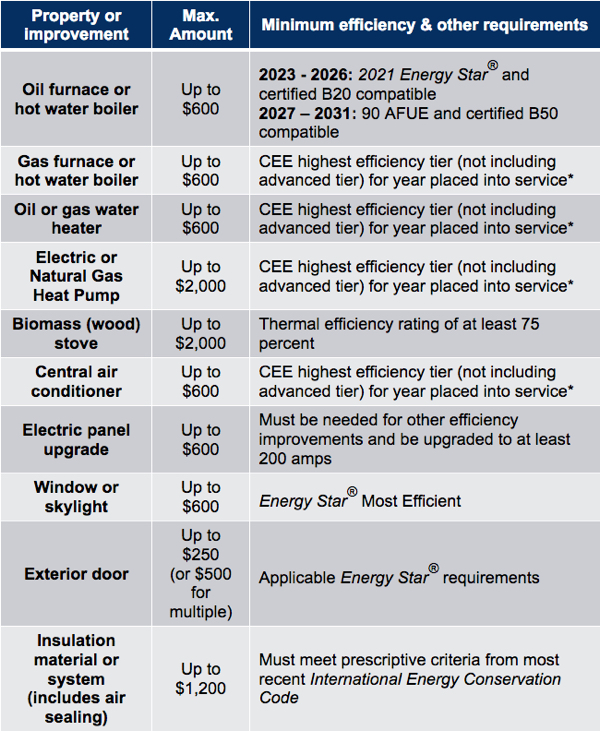

Qualified appliances and envelope components are subject to individual caps and minimum efficiency requirements. The new 25C credit offers a "menu" of choices for the homeowner (see the chart below). Added up, the total credit may not exceed an aggregate limit of $1,200. Electric and natural gas heat pumps are subject to a separate overall limit of $2,000. The IRS has determined homeowners may combine these two limits for a total credit of up to $3,200. The credit is non-refundable, which means a homeowner must have tax liability to benefit.

Oil-fired furnaces or hot water boilers are eligible for up to $600 under this credit. To qualify, the system must be placed into service between January 1, 2023, and December 31, 2026, and meet 2021 Energy Star® criteria, which is 87 AFUE for boilers and 85 AFUE for furnaces. It must also be rated by the manufacturer for use with renewable fuel blends of 20% or more. Beginning January 1, 2027, oil-fired boilers and furnaces must achieve at least 90 AFUE and be rated for blends of 50% or more to qualify.

NEFI advocacy efforts in 2021 and 2022 resulted in the inclusion of the heating oil language in the new law. Our efforts also enjoyed the support of the Oilheat Manufacturers Association (OMA) and its members and were made possible by the generous contributions to our annual advocacy fund. A list of supporters and donation form is available at www.nefi.com/donate. Thank you to all our contributors. We hope you will continue to support us in the New Year!

HVAC appliances other than oil-fired furnaces and boilers and biomass (e.g., wood pellet) stoves must meet minimum efficiency ratings established annually by the Consortium for Energy Efficiency (CEE) to qualify. This includes natural gas and propane systems. Under the IRA, these appliances must meet the highest CEE efficiency tier, not including the advanced tier, for the year in which it is placed into service. Click here for the CEE qualifying products lists.

The new 25C credit also offers consumers up to $150 for a home energy audit. The IRS requires that the energy auditor provide a written report to the taxpayer that identifies the most significant and cost-effective energy efficiency improvements for that dwelling, including an estimate of the energy and cost savings for each such improvement. The IRS notes that additional guidance will be forthcoming, including what certifications will be required of the auditor.

NEFI encourages its members to read through the IRS guidance document (link below), particularly rules governing how other state and federal tax incentives and public and private rebates are to be treated with respect to the 25C credit. In addition, the IRS document provides detailed guidance on the expanded 25D credit for residential "renewable energy" property including solar panels, geothermal systems and battery storage technology.

These tax credits are separate from - and not to be confused with - new point-of-sale rebates created by the IRA. The new law provides $9 billion, split evenly between rebate programs for residential electrification and envelope efficiency improvements that offer up to $14,000 and $8,000 per home, respectively. The IRA requires these programs be set up and administered by state governments. The U.S. Department of Energy is expected to issue guidance in early 2023 on how states are to set up and administer these programs. However, it could take many months or even a year or more to fully roll out these rebate programs. Click here to see how much funding your state may get for these programs.

As with all tax or legal matters, we strongly encourage you to consult with an accountant, attorney, or other qualified professional. For more information on this alert, please contact NEFI at (202) 508-3645 or email jim.collura@nefi.com.

admin - 03:01 pm -

December 30th, 2022

admin - 03:01 pm -

December 30th, 2022